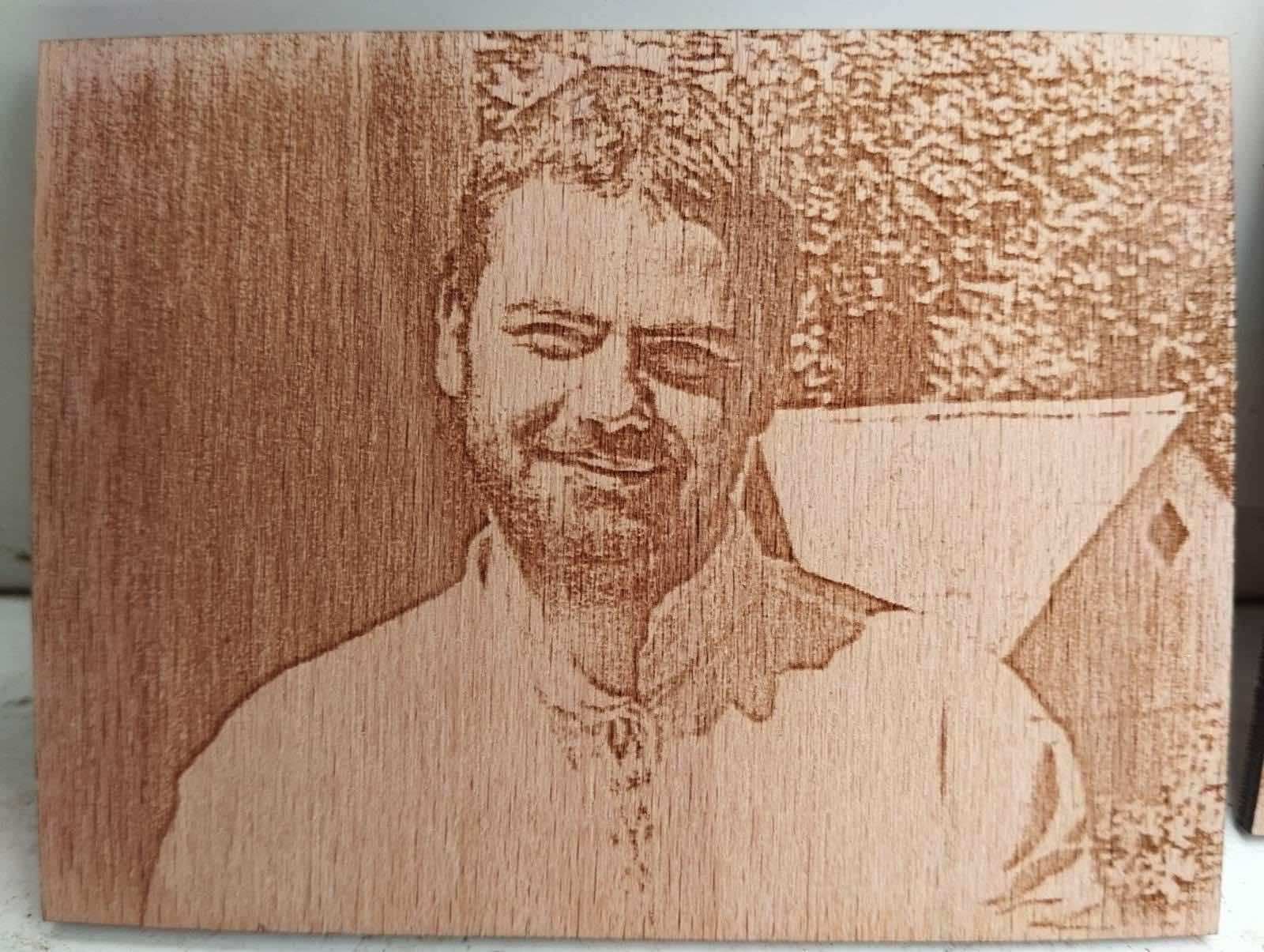

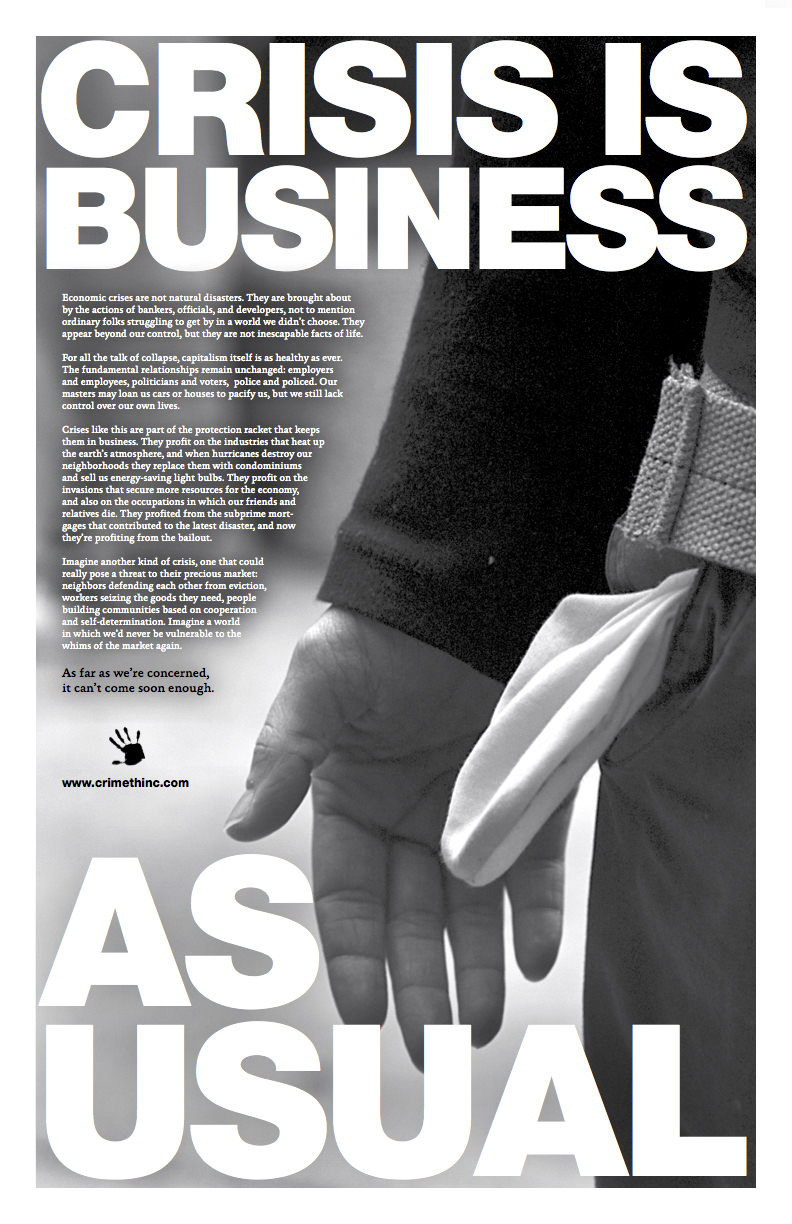

Here’s a new poster on the economic crisis, perfect for wheatpasting in neighborhoods with a lot of foreclosures.

Everybody knows that you’ve got to have money to make money, and never is that more true than in a speculation-driven economy. As the stock market reached unprecedented heights, its connection to the nuts and bolts of the economy became more and more illusory, making a “correction” inevitable–and profitable, for some. Gambling on the correction became a money-making scheme in its own right, and continues now after the collapse, without regard for the fact that such late-game betting assures that the recession will be all the more severe. Institutional investors can afford to play this game because, for them, a collapse of the stock market just means an opportunity to gamble on bonds or currency or whatever other financial product which might benefit from the disappearance of trillions of dollars in artificial value.

But if the value lost in the stock market is artificial, the consequences for human beings are very real. The ranks of the unemployed are rising by the hundreds of thousands every month. Inflated prices for consumers goods will largely stay inflated, even as earnings decline and homes are repossessed. And while the ultra-wealthy will ride out the recession in a riot of luxury and consumption, everyone else will be faced with a new, harsh reality—one in which the means of subsistence are increasing hard to achieve.

So for all the media’s obsession with stunned stockbrokers and disgraced corporate tycoons, their suffering is distinctly abstract: paper losses to be pondered during a long and comfortable early retirement. The rest of us will be forced to wonder why the most basic needs of our lives—food, shelter, medicine—are tied to the whims of a marketplace designed for collapse.